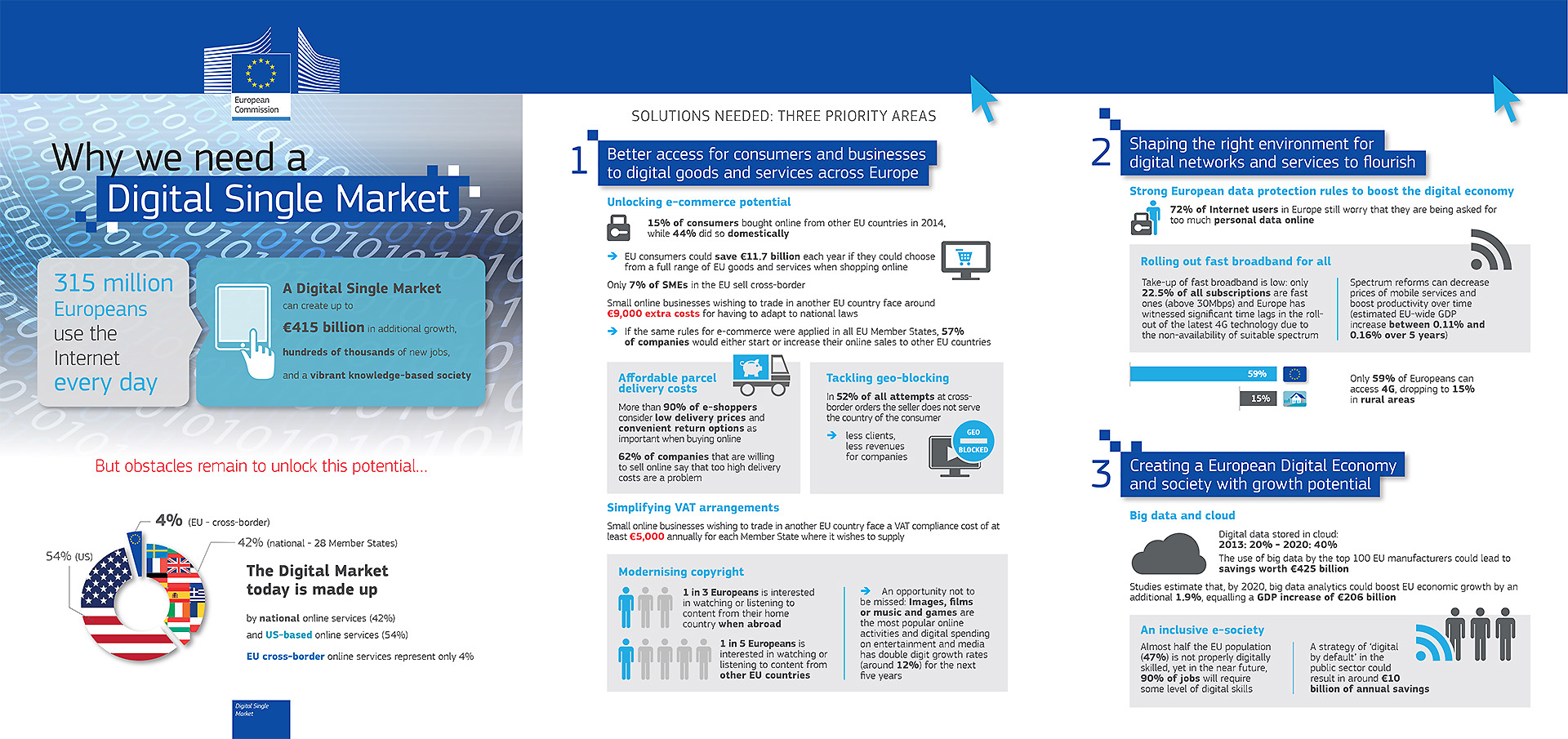

Although GoG operates a credit system for those that are forced to pay more for their digitally downloaded games simply because of where they are from, the pricing system of different titles in Europe has always been a difficult one to justify. We may never have anything as cheaply as our American cousins, but game pricing in the EU should get a little fairer in the near future at least, as the Digital Single Market proposed by the European Commission will force uniformity.

That means that whether you live in Lithuania, Spain, the UK or anywhere else within the European Union, your digital games will cost just as much. This would be regardless of platform, so while individual providers may price their games higher or lower than one another, Xbox Live, PSN, Steam and all of the others would have to keep their prices uniform throughout all EU territories.

“The Digital Single Market initiative seeks to provide an unfettered European market for digital goods and services across all its 28 member states,” the Commission said to MVC.

Developers are already on board with this system, with indie game maker Kiss' head of marketing, David Clark stating: “To suggest to the consumer that the cost of selling a digital product or a physical product sold via a digital outlet can vary from country to country is becoming ever more difficult to justify. Businesses suggesting otherwise are simply adopting the King Canute approach.”

The Digital Single Market strategy was adopted on 6th May 2015 and is pushing to make the unified digital product pricing a reality by the end of 2016. Although part of a separate scheme, the Commission is also pushing to instigate a new broadband standard that will see all EU citizens able to access high speed fibre networks of at least 30Mbps across the board and at least half of internet users connected to high-speed 100 Mbps connections.

Discuss on our Facebook page, HERE.

KitGuru Says: This all sounds like good news to me. Let's stay in the EU people, it'll keep the price of our games down and our internet speeds up.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

Same price does not equal lower price. It might or it might not be cheaper. At any rate, it is also rather difficult to equal prices given each country having a different general tax (VAT) than the one next to it

Prices should be based on average income, not where the country is geographically. Latvia and Sweden have a few hundred km of sea between them, but have drastically different average salaries (2600eu vs 550eu). In both countries people have to pay 50-60 euros for a game.

GET A BEST TOP253-CAREER ::: @1md4.

bc.

http://www.Home-Job-ConceptsBest7/top6/yes...

⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛

LOGON TO THE SITE –>>CLICK TAB FOR MORE DETAIL AND HELp

That is why we need an EU fiscal union where Vat is the same across the EU.

And it should be applied in the follow methods

First have Two VAT A low food vat like here in Italy where it’s at 4%, and a general one like 20 max 21%

In Britain we have no vat on essentials and then 20% vat on all other things. A rebalanced of 17.5% should be the pursued option

I don’t agree with your numbers but the principle is sound. Having a fiscal union with standard VAT is a good idea.

This will have the same effect as making male and female car insurance the same price.

It did not mean that male car insurance prices got lower, it meant that female car insurance was bumped up to the same price as male. We should expect to see UK prices, for instance, rise.

Wow can’t believe in Britain there’s no VAT on essentials, in Spain it’s 21% and in Romania 9% (Romania did it far better than Spain, they’re going to lower general VAT to 19% soon… while Spain increased it from 18% to 21% around 2 years ago lol. If it got lowered back to 18% would be awesome)

Ok that’s BETTER!!!!!!

again all vat on essential foods and medicine and utilities do is hurt the most vulnerable and doesn’t make sense if you end up subsidising those things. Things like a computer and restuarants are all luxury and should be taxed. (although I guess you need at least a phone to get a job these days)

GET A BEST TOP256-CAREER ::: @1md7.

bc..

http://www.Home-Job-ConceptsBest4/top3/yes...

⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛⚛☤☤☤☤☤⚛

LOGON TO THE SITE –>>CLICK TAB FOR MORE DETAIL AND HELp

Ever heard of “price discrimination”? A cinema charges less to students than to richer people. Look it up.

The problem of course is how you define essentials and the added complexities, costs and distortions, that arise from any definition you come up with. There are a number of known examples from the UK like the Jaffa cake one but it’s not that hard to conceptialise anyway.

If you define all food as essential then you get the odd definition where Beluga caviar which costs $10000/kg or whatever is untaxed, and a $300 computer whiich actually can be essential for some and at least greatly beneficial for others, even many who are poor, is untaxed.

If you decide that beef is essential but other less common meats are luxuries you have the problem where Kobe beef is essential, but whatever meat falls outside our definition which may be significiantly cheaper, perhaps healthier for certain people and perhaps even arguably more enviromentally friendly or raised more humanely, is a luxury.

And the more you make complex definitions of luxuries and essentials to fix such distortions, the more costs you tend to add due to people having to decide, and perhaps argue in court over these definitions. And also working out loopholes they can use to make their product fall in to the essential category despite their product any better for anyone. At best, you may end up with a lot of small distortions rather than a few major ones.

However, you’re right that the added cost for welfare/support to people the government needs to pay due to the higher prices, has to be considered. Note this is primarily due to the extra people you have to support. It’s not the because you have to pay more to those you are already supporting.

It may seem dumb to pay someone $1200 instead of $1000 because 20% of their income is going on VAT but the actual extra cost to pay someone $1200 instead of $1000 is probably only slightly higher than $200. (But there’s a cost to each person you support, so having to support more people because of the higher price of essentials will raises costs a fair amount more than simple what you’re paying them.)

Remember that although the extra $200 may still seem dumb, it’s perhaps less dumb when you consider that now the people who don’t need your support whatever the case, are also paying the added extra 20% on these items you consider essentials, some of which may be actually stuff few poor people will buy due to cost because as mentioned, realisticly you’re always going to have stuff that falls through your cracks.

And further since the prices aren’t distorted by your differing definitions, the person who you are paying $1200 may chose to spend the extra $15 they manage to save from their income+support on a “luxury” like watching a documentary at a movie theatre which may help them in some way rather than on “essential” food they don’t really need since they already get sufficient food, and which if anything, is only going to increase the chance they’ll have medical problems in the future.

Since you know what you do will generally affect not only the ultra poor who you require government support but also the more middle class you don’t, you may be partially using your essentials vs luxuries to intentionally

distort the market i.e. with the assumption certain items and

practices are better than others. This is a noble goal, but it too often has similar unintended consequences. If raw chicken, flour and oil are essentials which you don’t tax but processed chicken is a luxury, the fried chicken you make from those raw ingredients will probably be less healthy for many than the processed smoked chicken. (The other thing is when the government is making such decisions, there’s always the risk they’ve got it wrong.)

The NZ GST (VAT) system is fairly well known for its simplicity with

only one rate covering nearly all goods and services and not much

zero-rated, so it’s IMO a good comparitive example despite the

differences between NZ and most of the EU. (Which doesn’t mean there are

no court cases or problems here. Although our biggest current problem

is probably not due to the system itself, but how to handle end user

imports and digital services in the internet age. Not helped by our

small size meaning it’s far harder to force foreign companies to comply

than it is for the EU.)

Note I’m not saying the NZ system is definitely right. Actually I tend to fluctuate on whether or not we should accept a little less simplicity. So nor am I saying the system most other countries use where they do tend to exclude “essentials” is a bad idea.

All I’m saying is if you want to decide which system is better, you need to consider how the systems work in practice, the interplay of the problems, distortions, costs they bring, why these occur and why they can’t be avoided. Only then can you decide which one is better. And I’ve only really touched the surface of the complexities involved.

Since my previous post was already so long that few will read it, I’ve seperated this. To give one example from NZ, one thing people often criticise is the fact that there is GST on council rates.

While I agree this seems dumb, if you were to remove it you have to be careful it only covers compulsory rates. There’s a strong move to user pays in a number of areas, which amongst other things, often opens services up for competition. However, clearly if I don’t have to pay GST to my council to collect my rubbish, but I do have to pay a private company, the private company is going to be a comparative disadvantage. AFAIK, it probably wouldn’t be that hard to prevent this in legislation, but it does explain why you have to be careful of unintended consequences.

And even with good lesgilation, there are still possibly distortions. For example, consider if my council asked me if they wanted household rubbish collection to continue being down out of compulsory rates meaning the only competition would be on tenders to the council, or to make it user pays. Even if I use the service the same as the average and believe there are inefficiencies in the council which a private company will not have meaning I may pay less before GST if it’s opened up to competition, the fact I have to pay 15% more because it’s now not part of the compulsory rates part may make it not worth it.

Same problem if I think costs will probably end up the same and I may even still use the council’s service, I just prefer user pays because I think it’s fairer or better or whatever. Is it really worth me adding 15% to the cost?

To avoid debate, I should mention that in reality, the added complexity of payment collection means user pays will tend to end up more expensive, presuming the benefit of competition doesn’t reduce costs, but the main idea stands.

Mind you the biggest reason why the government is unlikely to remove GST from rates is not because of the complexities that may result but simply because it’s already an established part of the tax base which gets grumbles but works. If it’s removed, the government either has to accept lower revenue or replace it by increasing tax in other areas.

What people consider an essential and what the government consider an essential are two very different things. Food most has vat on it unless it’s a carrot and a loaf of bread. Did you warm that food up well now we will charge you vat are you sure you need liquids to survive vat it ect ect ect.

I think a good thing to do would be allow people who earn less to claim some vat back every year as long as they produce receipts.

I wish I could believe that everyone will have 30mbps by 2020 yeah.

As someone who lives in the middle of nowhere seeing the way the uk government handles contracts that only benefit areas that already have above average speeds, and no clause that forces these companies to supply a better service to those people who have next to none is laughable.