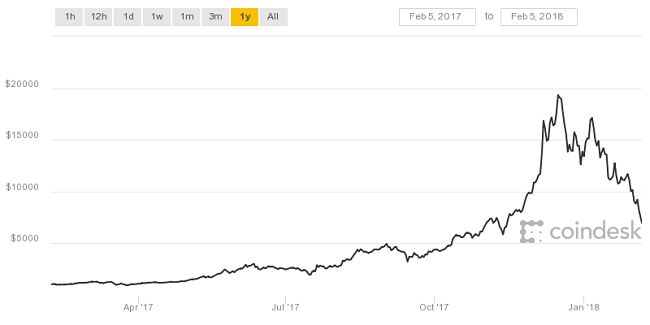

Just a few years ago, the word “Bitcoin” was only well known in technological circles. Ask the average person what it was, and they would give you a worried look. But at the end of 2017, as the value of a single Bitcoin approached $20,000 from under $1,000 at the beginning of the year, everyone was taking notice. Mainstream news sites were leading on the headline, and stories proliferated everywhere. Bitcoin was a mainstream story.

When something increases its value twentyfold in a year, it’s not surprising that even BBC prime time news is reporting on it. After all, who wouldn’t want to get that rich that quickly? But Bitcoin isn’t quite as simple as a license to print money – just get on the bandwagon and you too could be a billionaire. At the time of writing, the Bitcoin goldrush seems to have hit a bump in the road, dropping back under $10,000 per Bitcoin. Seasoned Bitcoin watchers will tell you this is no surprise, nor anything particularly new.

With all the hype surrounding Bitcoin and alternatives such as Ethereum, plus cryptocurrency and blockchain in general, we though it was high time we investigated whether you can really make some money from cryptocurrency. In this feature, we will be trying to get to the bottom of what blockchain and cryptocurrency actually are, why they came into being, and what makes these systems different from other more conventional forms of digital cash.

Once we’ve got the theory straight, we will then look at the different types of cryptocurrency. Wikipedia lists 45 cryptocurrencies as “notable”, but there are in fact over a thousand different “alt coins” to choose from. Of these, however, only a few are worth considering if you’re new to the game, and even if you’re an old hand. We discuss the key contenders, then look at how you can potentially generate your own cryptocurrency stash, rather than merely buying in, by “mining” the hashes that accredit value in cryptocurrency. We will then pit some popular graphics cards for mining from AMD and NVIDIA against each other, to see which is the most efficient choice, before assessing the profitability available.

Finally, however, we will discuss the growing issues with cryptocurrency. One of the reasons for the more-than-halving in value of Bitcoin at the time of writing was the way governments are clamping down on exchanges, and there are also concerns about how much power and bandwidth Bitcoin consumes in its transactional mining systems. These issues could be blips, or they could be deal-breakers, and there are lots of other potential problems too.

Nevertheless, even with these difficulties, there is no denying that cryptocurrency is now a worldwide phenomenon, and fascinating on many levels. It’s interesting to ask why it exists in the first place, because the technology is complicated and a rewarding challenge to get your head around, and mining your own fortune can be lots of fun too, even if you fail to get anywhere with it. So read on for our definitive, ultimate beginner's guide.

What Is Money Anyway?

Before we delve into the practicalities of cryptocurrency, we thought it would be a good idea to understand exactly how it works and why it exists. To do so, we should also consider why we have money in the first place. Before money existed, if I had a cow and you had 40 chickens, we could agree on an equivalence between them and do an exchange – maybe 30 of your chickens were worth my cow, or one chicken for a pail of milk.

But, obviously, if I had to bring my cow to you and you had to bring your chickens physically to the same place, things could get a little noisy. Also, what if I wanted to exchange my cow for some of your chickens and some potatoes from another farmer? This would be difficult without chopping the cow up, which would inadvertently affect its health.

A much easier system would be one where the value of my cow was represented by tokens of some sort, a bit like the way the word cow refers to a cow without actually being a cow. Obviously, if we just used some sticks then any charlatan could get some sticks and pretend they’d got these for their own cow and get some chickens, when all they did was pick them up in the forest. For this reason, it seemed like a better idea to make these tokens of value out of something that was rare and hard to find, like a precious metal.

This is still missing one element, however. Tokens of value, even ones made out of precious metal, aren’t going to be very useful if you show up to buy some chickens and the chicken owner tells you they don’t recognise your tokens of value as being worth anything and so won’t even give you an egg in return for them.

This is why our classic tokens of value, coins made out of a precious metal, have the symbol of a government or empire on them. If someone denies the value of the coins, the government in question can send the troops round to explain forcibly, using weapons, that actually the person is mistaken. They really should be willing to exchange chickens for coins, unless they fancy having their chickens stuffed where the sun don't shine, rather than vice versa.

Once you’ve separated the value part of the token of value from the fact that it’s made out of something rare and exotic like silver or gold, you’re left with the guarantee from the government that issued it. So long as you can trust that the government was the source of the token, and it wasn’t like the sticks we mentioned earlier, a token of value could be anything that resists counterfeiting. It could be a specially printed and sealed bit of paper, or simply a mark on a ledger kept under secure protection by the government or a trusted third party.

With the advent of digital networks, the record of who has what amount of value stopped needing to be represented by a pile of gold coins, paper notes, or a physical ledger. It could be a number in a database. But the value still effectively came from state backing. Although the database will be held by a third party like a bank, the value will be stated in a currency issued by a government. The thing that ensures the value of that currency is still the threat that troops will come round and insist upon it, although they would probably be using more potent weaponry than they did when it was all about cows and chickens.

This is still where we are today with mainstream money. You could still swap cows for chickens directly, and use gold coins and paper notes. But most of our transactions are simply a secure transfer of data values that represents an exchange of value between people. If the government backing that value gets into trouble, then so does the value. In this context, a new idea emerged about what money could be, inspired by the way the Internet appears to have transcended governments and become something global. This was what became cryptocurrency, blockchain, and Bitcoin.

Why Blockchain and Cryptocurrency?

The Internet was invented by funding from a US governmental body called the Defence Advanced Projects Research Agency (DARPA). But since the core technology was provided openly and royalty-free to use, it became what we know it to be today – a decentralised system that doesn’t seem to be fully controlled by anyone, although some countries and companies have more influence than others.

At its core, cryptocurrency is trying to do for money what the Internet has appeared to do for communications. One of the main aims, particularly for Bitcoin, was to take the governmental control away from money, and this is where things get a bit more complicated – and political. Although cryptocurrency is very much a technological solution, its underlying premise represents something quite a bit more ideological, intended to address problems with money as it currently exists.

One of these problems is to do with inflation, and if you happen to be from Zimbabwe or Venezuela, you will know exactly how bad this can be. But inflation is a factor for pretty much all currencies everywhere in the world. In a nutshell, money always loses its value in real terms over time. The amount of money needed to buy a cow today won’t be enough in a few years’ time, let alone 40 chickens, so if you just sit on your money, eventually it will be worthless. Part of the reason for this is that governments can simply print more money when they need it – such as the so-called “Quantitative Easing” that the Bank of England used to alleviate the effects of the 2008 crash.

One of the ironies in this situation is that the most popular precious metal used to create traditional money – gold – doesn’t have this problem as a commodity. Its value does go up and down, but the general trend is up. However, for a long time the value of gold was pegged to a fixed number of US dollars. From 1792 to 1833, one ounce of gold was $19.39, then from 1879 to 1932 it was $20.67, and at other times it was fixed via a system called the Gold Standard at different levels all the way until 1976, when the current era of consistent inflation began.

Advocates of Bitcoin and cryptocurrency in general see this as a major issue. They want a return of something like the Gold Standard, but in the digital realm. Instead of a rare physical commodity like gold, they suggested solutions to cryptographic puzzles as the basis for currency. The difficulty of these puzzles increases, so the quantity of solutions that can be found in a given amount of time gets more limited, providing similar increasing scarcity to gold. This prevents the currency from being inflationary, like national currencies where more cash can be printed whenever needed.

The job of solving those puzzles is the key factor for decentralisation. In a system with some resemblance to BitTorrent peer-to-peer file sharing, anyone can contribute to this task. They simply supply some computing power, for which they will be rewarded with currency. This is what mining is, and nobody has overall control over the process, fulfilling the requirement to avoid the centralised authority that is essential for traditional financial systems. Understanding how this mining fits with the shared ledger, or blockchain, is central to getting your head around how cryptocurrency works as a system. So we will turn to this next.

How Mining and Blockchain Fit Together

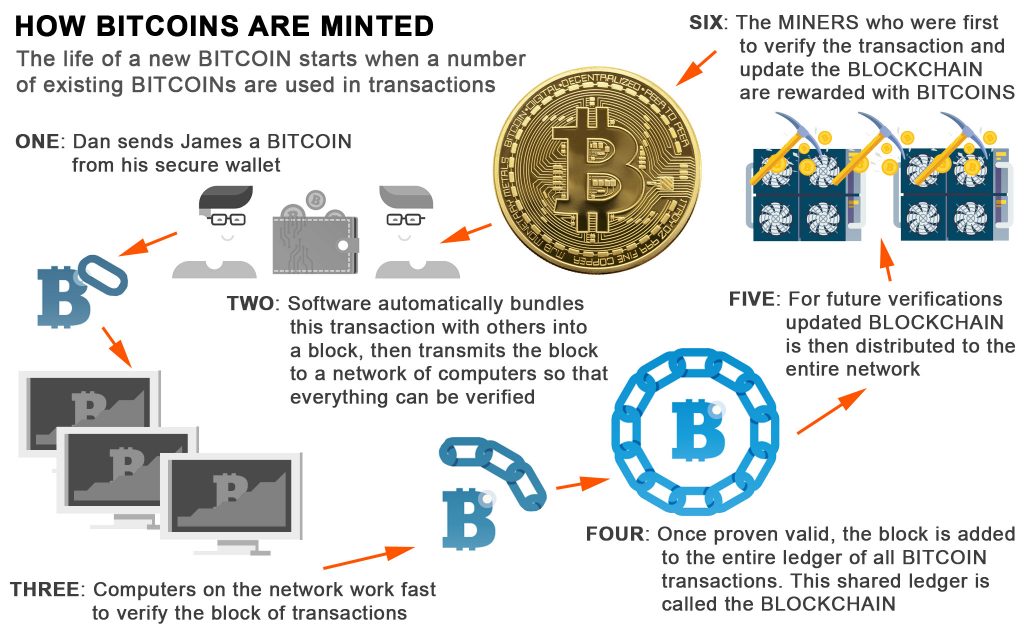

The word “blockchain” has become synonymous with cryptocurrency, but in fact this is just one part of the system. The blockchain is the ledger, equivalent to the database of value held and transactions completed that we talked about earlier in this feature. The big difference is that, whereas the primary function of traditional banks is keeping their ledgers secret and hidden, the blockchain is meant to be entirely public. The fact that it is all over the place and cryptographically signed gives it security from cheating, at least in theory, although later in this feature we will discuss some of the problems with this configuration.

The concept of the blockchain was created by the mysterious Satoshi Nakamoto, the father of Bitcoin (or it could be mother or even parents, because nobody knows who Satoshi Nakamoto is). As the word “blockchain” implies, it’s a chain of blocks, and each block contains a bundle of transactions, depending on the size required per transaction and the size of a block. For Bitcoin, a transaction takes about 495 Bytes, and a block is 1Mbyte, so it contains up to 2,020 transactions. But other cryptocurrencies use different block and transaction sizes.

In order to add a new block of transactions to the blockchain, all the transactions contained within it need to be confirmed. This is what cryptocurrency miners do. They perform a cryptographic function to find a hash that connects the new block to its predecessor in the blockchain. In Bitcoin, this is based on the SHA 256 Hash algorithm, but other cryptocurrencies use different algorithms.

Mining is competitive, with miners vying to be first to find the hash for a given block. If they are first, they are rewarded with a newly minted piece of cryptocurrency. Apart from when a new cryptocurrency is first launched, this is the only way to mint new coins, which is how the supply is limited. Since miners actually have to perform some computing work, this keeps a check on any organisation simply pumping currency into the system. However, it doesn’t stop economies of scale in mining via computing farms, but it will prevent complete monopolisation.

In other words, a cryptocurrency is distributed in two main ways. A distributed network of peers holds copies of the blockchain, and you could even keep a copy on your own computer, becoming part of this network. A distributed network of peers also performs the mining that verifies transactions and adds new blocks to the chain and mints new currency in the process. This means that the minting is distributed too.

Although most cryptocurrency systems have this same basic structure, there are now lots of them with subtly different characteristics. So next we will turn to an overview of Bitcoin, Ethereum, Ripple, Dogecoin, and the market-leading alternatives that now exist in the fascinating and ever-expanding world of blockchain.

Bitcoin, Ethereum and Alt Coins

Since Bitcoin arrived in 2009, numerous alternatives have emerged, either based on derivatives of the same core code or developments of the blockchain idea. Bitcoin is the granddaddy of cryptocurrencies of course. Looking at market capitalisation – which is the total value of all the currency in circulation – Bitcoin is way ahead, at over $156 billion at the time of writing.

The clearest contender to Bitcoin’s crown is Ethereum, with just under $96 billion. Ripple XRP is a distant third, at $37 billion. Then there’s Bitcoin Cash, at $21 billion, Cardano at $11 billion, Stellar, NEO and Litecoin at $8 billion, EOS at $7 billion, and NEM in tenth place with under $6 billion. You can see a long list of cryptocurrencies and their market cap here.

Other cryptocurrencies worth talking about for significance and amusement value from the enormous list are Monero and Dogecoin. But at the time of writing there were 892 coins and 582 tokens being tracked on the CoinMarketCap website, with a total combined value of $440 billion. So there really is a deluge of alternatives to Bitcoin, or “alt coins”, and anyone with sufficient coding skills can potentially fork a cryptocurrency’s code to make their own, with the most significant recent example being Bitcoin Cash, which was forked from Bitcoin on 1st August 2017.

As we just mentioned, some cryptocurrencies are called coins, and some are called tokens. The distinction is whether a cryptocurrency is directly connected to its own blockchain or other transaction ledger system. If it does have this structure, it’s a coin. If the cryptocurrency sits on top of another platform, without having its own blockchain, it’s a token. The vast majority of tokens sit on the Ethereum platform, with just a smattering using Omni, NEO and other platforms.

There are numerous subtle differences between Bitcoin and its pretenders, including smart contract support, but some of the main ones are how mining is reimbursed and the size of a block in the blockchain. The latter has an impact on global transaction speed, which is becoming one of the main issues with the viability of Bitcoin compared to its competitors. Monetary supply – the amount of coins available and how rapidly they are released – is also a key differentiating factor.

Bitcoin

More than 80 per cent of all 21 million available Bitcoins have already been mined, and the rewards halve every 210,000 blocks. At the time of writing, the reward for mining a Bitcoin block was 12.5 bitcoins, but this will halve to 6.25 around 3rd June 2020. There’s a handy tracking countdown at http://www.bitcoinblockhalf.com/.

It takes around ten minutes to generate a block, which has a maximum size of 1MB. As a result, Bitcoin can only process between 3.3 and 7 transactions per second, which is going to be an increasing scalability issue if more people use the currency for everyday financial transactions. This is part of the reason why Bitcoin transactions have become significantly more expensive and unreliable in the last couple of years.

Ethereum

Ethereum is called a second generation cryptocurrency, as it is built to avoid some of the problems found with Bitcoin. Mining an Ethereum block used to earn five ether, paid in return for a similar hashing process as Bitcoin. There was also a system whereby 2-3 ether were awarded to other miners who found the solution but didn’t get added to the blockchain, called an uncle/aunt reward. However, after the Byzantium hard code fork in October 2017, the earnings dropped to three ether for mining and 0.625-2.625 ether for uncle/aunt rewards. However, this “proof of work” system may be replaced by a “proof of stake” system that doesn’t involve mining in the future.

Etherium doesn’t have a fixed maximum block size in the same way as Bitcoin. Instead, transactions are given a cost in “gas” based on storage needs, complexity and bandwidth usage, and miners vote on a “gas limit”. So the size of an Ethereum block varies, albeit with a general upwards trend, sitting around 25KB at the time of writing.

You can see how the Ethereum block size has changed over time at Etherscan. There’s also a handy live stats page for Ethereum performance, although it’s not a complete picture of all Ethereum traffic. Processing a block takes about 15 seconds, and this means that around 15 transactions are completed per second. This is better than Bitcoin, making Ethereum a bit more scalable, but only about twice as much.

Ripple XRP

There is increasing interest in Ripple XRP, although its market cap is currently way behind the top two cryptocurrencies. Ripple is the organisation, and XRP the actual currency. It’s very different to most other cryptocurrencies in structure. Whilst Bitcoin is a public entity, Ripple is a private company. XRP boasts much shorter transaction times than Bitcoin, at around three seconds compared to at least an hour or much more, depending on fees, for Bitcoin.

Transaction costs are also much lower. Where a Bitcoin transaction can cost as much as $80, a Ripple XRP one is $0.004, and there can be 1,500 of them per second, making it much more viable for global usage. There is a supply limit of 100 billion XRP, although 55 billion are held in an escrow smart contract, which releases them at the rate of 1 billion a month, with unused XRP returned to the escrow at the end of the month for later release. Ripple estimates that it will take about 15 years for 90 per cent of XRP to be released.

Ripple also uses a consensus proof-of-stake system rather than distributed proof-of-work of Bitcoin and Ethereum. So you can’t actually mine it. The clients involved in the consensus algorithm are limited and strictly validated, not any end user with computing power to provide. Ripple claims to use blockchain technology, but it’s not decentralised on a peer network like other cryptocurrencies. This has made it much more attractive to banks and governments, because they can retain control.

Bitcoin Cash

As we mentioned earlier, Bitcoin Cash is a hard fork of Bitcoin, so is structurally very similar. However, the block size has been increased to 8MB, with an adjustable level of difficulty to improve verification speed, although this has caused security concerns. This could drop transaction times from Bitcoin’s ten minutes to two minutes 30 seconds. Right now, Bitcoin Cash can handle around 62 transactions per second, but performance could rise to over 240 per second with reduced difficulty. This will make the cryptocurrency more scalable than Bitcoin or Ethereum, although not so much as Ripple XRP.

Cardano, Stellar, NEO, Litecoin, NEM, Monero, and Dogecoin

There are so many alt coins we could never hope to provide a comprehensive comparison of all of them. But just looking at a selection from the top ten and beyond gives a flavour of the kinds of features that differentiate them.

Cardano claims to be based on academically peer-reviewed code, implying that it’s more rigorously constructed. Its main claim is how it separates smart contracts (about which more later) from its payment system, which uses its ADA currency. It uses a proof-of-stake system like Ripple XRP rather than the proof-of-work used by Bitcoin and Ethereum. As a result, you can’t mine it, with a complex system of slots and token-holding nodes doing the confirmation, although at the moment all these nodes are owned by Cardano itself. However, whilst Cardano currently has a similar transaction speed to Bitcoin, developers claim it will offer billions of transactions per second with a future update.

Stellar is based on Bitcoin’s blockchain technology, but with the ability to complete transactions in 2-5 seconds. A performance of at least one thousand transactions per second is claimed, and as a result IBM has partnered with the company, along with 14 banks around the world.

NEO is another cryptocurrency like Ethereum and Cardano that focuses on the concept of smart contracts. But it adds a public key-based digital identity system, which has to be added by a third party for Ethereum. Like Cardano, it uses a proof-of-stake system to confirm blocks, and its developers claim it can handle 10,000 transactions per second.

Litecoin has a faster transaction time than Bitcoin of 2.5 minutes and can handle 56 transactions per second. However, one of its chief differences is that it uses the Scrypt cryptographic algorithm rather than Bitcoin’s SH-256. Mining SH-256 is now much more efficient using optimised Application-Specific Integrated Circuits (ASICs), with which consumer-grade CPUs and GPUs are increasingly unable to compete. Scrypt is supposedly more accessible to everyday hardware, although ASICs are appearing that are optimised for it too.

NEM doesn’t have smart contracts built in, although lots of developers are building them on top thanks to an architecture that facilitates integration into existing networks. NEM claims to be capable of 4,000 transactions per second.

Monero in its current form can handle up to 1,700 transactions per second. It achieves this with variable block sizes, allowing very large blocks, although memory and bandwidth puts a limit on this in practice. However, Monero’s main point of interest, and the reason why we mention it ahead of coins with larger market capitalisation, is that it aims to keep the sender, receiver and amount of every transaction secret. For this reason, Monero is popular with those wishing to evade the law such as ransomware makers. It also aims to make its mining more egalitarian. Thanks to this feature, its mining code JavaScript implementation has found its way illicitly into websites and apps, leeching processing power without the owners’ consent.

Dogecoin seems to have been created as a bit of a joke, with a logo based around the Shiba Inu canine of the infamous Doge meme. It has gained favour as a social media tipping system on Reddit, Twitter and Twitch.tv. There is no limit to how many dogecoins will become available from mining. Over five billion are being produced a year, and 98 billion are already in circulation, with a 10,000-coin reward for each block mined.

These are just a few notable coins from the burgeoning array of cryptocurrency possibilities. One of the key skills in cryptocurrency mining is choosing the most profitable coin to mine at any given moment in time. Some mining pools such as NiceHash do this for you automatically, which is why it’s such a great place for beginners to start. But experts could do better by monitoring trends themselves and switching algorithms accordingly. Investors will also have their own strategic reasons for backing one cryptocurrency over another as the most likely to appreciate. Nevertheless, predicting which coin will come out on top is a black art – literally a minefield.

Smart Contracts and ICOs

Before we finally turn to the practicalities of mining, we should say a few words about some of the features of cryptocurrency that can elevate it beyond what traditional money is capable of. In particular, during our description of the various coin contenders, we mentioned smart contracts more than once as a differentiator between them.

One of the key innovations of Ethereum over Bitcoin is that it has a smart contract ability built in. Cardano goes further by having a smart contract layer that is kept separate from its currency layer. With Bitcoin, you have to use the Script language to build a smart contract on top of the currency transaction. You might be wondering what all the fuss is about, and why this is considered important.

Basically, a smart contract is one where a payment and the conditions for receiving it are rolled into one package of code. Once you fulfil the criteria, your account is credited, and the transaction cannot be revoked at any time. No third-party enforcement is required, because the sender of funds has set the conditions for payment in the blockchain code, and once the receiver achieves those conditions, they get paid.

The idea is to counteract those times where (for example) you complete work for a client according to their wishes, but they delay payment or don’t pay at all. Or, alternatively, a worker doesn’t complete the job but takes the money anyway. This makes most sense with activities taking place entirely in the digital realm, or that are fully automated. For example, you could commission a self-driving taxi to get you from A to B for a fixed fee, and when it gets there, registered by GPS, your account is debited automatically.

The term “smart contracts” comes from Nick Szabo, who also came up with the idea for “bit gold”, a precursor of Bitcoin that was never implemented. Some have speculated that Szabo is actually Satoshi Nakamoto, the mysterious unknown inventor of Bitcoin, although no certain evidence has been found to prove this. Smart contracts use a technology called “Byzantine fault-tolerant algorithms” that can cope with imperfect information.

Smart contracts are particularly important for Initial Coin Offerings, or ICOs. These are crowdfunding mechanisms that aim to circumvent the costs of regulatory compliance and the needs of investing organisations like venture capitalists, banks and stock exchanges. The ICO name is intended to echo the mainstream Initial Public Offerings, or IPOs, where a company “goes public” and sells shares in order to raise funds for a new phase of growth and development.

However, instead of raising fiat currency funds, an ICO issues tokens worth a certain quantity of cryptocurrency, in exchange for existing cryptocurrency funds from the investor. When the project reaches its funding level and launches, these tokens become currency that behaves like conventional shares, appreciating as the project value increases. This process usually relies on some form of smart contract.

Thanks to its built-in smart contracts, Ethereum is used as the underlying cryptocurrency for more than 50 per cent of ICOs. However, as much as ten per cent of ICOs have ended up being phishing, Ponzi schemes and other scams. A Ponzi scheme is one where no profits are actually being made, with interest payments to early adopters taken from new investors’ funds. Ponzi schemes always eventually collapse when new funds are insufficient to pay off those cashing out.

Due to the lack of regulation, the risk from ICOs for investors is much greater than for IPOs. This dubious nature of ICOs has led to China banning them entirely in September 2017, with a knock-on effect on the value of cryptocurrencies. South Korea also banned ICOs in the same month. The fact that tokens act like securities, which represent a guarantee of services, has also meant countries like the USA, Canada and France will regulate ICOs in a similar way to securities.

There has been a lot of talk about the huge profits to be made from ICOs, which has been calculated on average as 1,300 per cent. But the risks for small investors are huge, and global crackdown could mean that the honeymoon period is well and truly over. Nevertheless, the smart contract idea has plenty of interesting applications other than ICOs. For example, backup company Acronis now uses Ethereum's system as a way to protect and authenticate its data storage repositories.

Getting Started with Mining

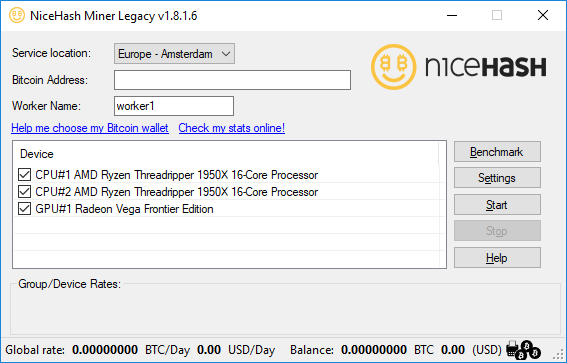

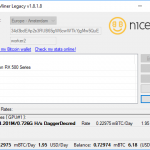

At first glance, cryptocurrency mining can seem pretty incomprehensible. Fortunately, now the concept has been around for a while, tools are becoming available to smooth out the process. One of the easiest ways to start mining is with NiceHash Miner. Like so many Bitcoin-related organisations, NiceHash has been hacked, to the tune of 4,450 Bitcoins, valued at $60 million at the time.

But the company is still up and running and is beginning to return funds to those affected. This is good news because its NiceHash Miner really is very easy to use. There are now two versions of the software. The ultra-simple Version 2 unfortunately stopped supporting AMD graphics cards with a recent dot release. So it’s only usable if you have NVIDIA graphics card(s) in your system.

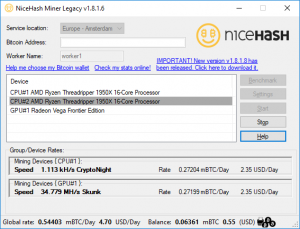

Fortunately, the more clunky-looking “Legacy” version of NiceHash that does support AMD GPUs is still being maintained and updated. This also exposes more options, and can use the same underlying hashing algorithms, so you won’t lose anything by opting for it. Both versions of NiceHash support CPUs as well as GPUs, so you can make use of your processor as well as your graphics, although not all CPUs are worth mining with.

To help you work this out, NiceHash also provides a handy online tool that will calculate the profitability of various common hardware choices, based on your kWh electricity unit costs. If you have cheap power or somehow are managing not to pay for your power at all, any hardware will be worth using. But for most of us there are some sums to be done to work out whether you should be using your existing kit. We will be going through some calculations with some sample hardware later in this feature.

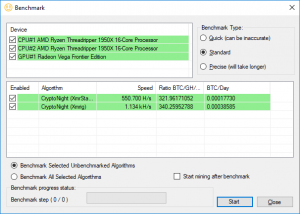

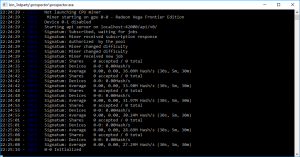

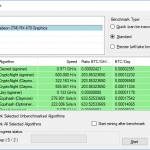

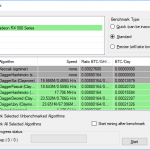

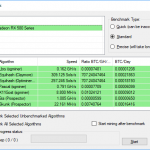

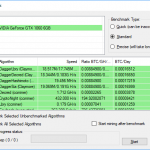

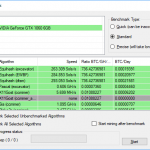

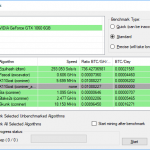

NiceHash is essentially a mining broker. It accepts mining orders and then resells its users’ mining power to fulfil those orders. As a result, one nice thing about NiceHash is that it breaks up work into smaller units, and distributes these between a group of users who wish to sell their hashing hardware power. So anyone can make a start at mining and get paid. Another attractive feature is the way NiceHash miner benchmarks your hardware, and works out what the currently most profitable hashing algorithm is for it. Your CPU and GPU will then be given workloads dynamically based on the live situation and their measured capabilities.

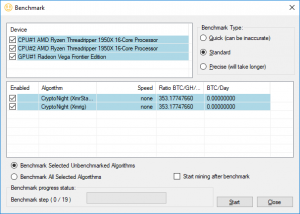

For a novice user, this takes a lot of the pain away from working out what’s the best cryptocurrency to mine right now, although this is also part of the fun, once you have a better idea what you’re doing. In fact, NiceHash Miner, even in Legacy form, is unbelievably easy to use. Once you have downloaded the software, fire it up and run the benchmark. You can choose to do this with all the devices on your system, or just the ones you select.

The benchmark runs a plethora of algorithms to ascertain your hardware’s abilities with the hashing platforms that NiceHash Miner uses. This can take quite a long time, particularly if you chose the Precise benchmarking option. Once this process is over, however, you’re almost ready to start mining. The final piece of the puzzle is a Bitcoin address to mine to. This can be an external address, or one using NiceHash’s own internal wallet system (of which more shortly). Either can be used, but there are significant differences in when you will get paid for your mining with an external wallet. If you’re using the NiceHash internal wallet, the miner will credit your account when your mining reaches 0.001 Bitcoins, whereas an external one will have to wait until at least 0.01 or 0.1 Bitcoins, which could take months to achieve even with powerful hardware.

Once you have the Bitcoin address you will be using, you then copy this into the NiceHash Miner interface, give your worker a name, and click Start. The interface will then query the NiceHash servers for the best current algorithms to use, then fire up the requisite hashing software. You can then sit back, listen for your system fans to rise as the workloads kick in, and leave things running, probably for days. Unless you have a potent collection of GPUs and CPUs at your disposal, it could be a few days before your first payout reaches your NiceHash internal wallet – and much longer for an external one.

Mining for Experts

NiceHash really does make mining relatively painless to start out with. There are other GUI-based pool systems as well, such as MinerGate and Mining Pool Hub. However, although MinerGate is even easier to use than NiceHash, it gets detected by Windows Defender as a trojan, and Mining Pool Hub is a bit more complicated to configure.

You can use Mining Pool Hub with MultiPoolMiner, Awesome Miner or NemosMiner. Like NiceHash, this system can switch between algorithms automatically depending on profitability. Or you can select specific coins to mine by port number, with the help of What To Mine, which tells you which coins are currently the most profitable to mine. Choosing this option could be for when you have optimised your hardware for a particular algorithm, or have a specific strategy for the coins you plan to mine. For example, you could be betting on Litecoin as an appreciating cryptocurrency.

If you really want to create your own bespoke setup, you will need to pull together the elements that a service like NiceHash provides in one package. You will need a wallet to store your earnings, either stored locally or via an externally managed service. For example, you could use Ledger Nano S, Electrum, Mycelium or breadwallet. USB-connected hardware wallets are available too.

Next, you need some mining software, such as Bitcoin Miner, CGMiner, EasyMiner, or AMD’s miner if you’re using the latter’s graphics cards.

You will need to join a mining pool, such as the aforementioned Mining Pool Hub, Slush Pool or CGMiner’s pool. There’s a useful list of pools available at CryptoCompare. A pool is a necessity, because only the very largest amount of hardware can now hash an entire block quickly enough to win the prize of coins. Grouping together into a pool means a collective can still win, and then split the proceeds between them.

After that, you will need the exchange and bank transfer methods we will be describing later in this feature.

Although the NiceHash software has some configuration options for its algorithms and how they work with your hardware, using a bespoke mining setup will allow you to experiment with settings and optimisation for the best possible returns.

If you really want to disappear down the rabbit hole, you can tweak your hardware specifically for mining. Popular graphics cards can have modded BIOSes installed that expose features specifically for mining. For example, overclocking the memory so much that it causes visible artefacts can still improve hashing performance, although you wouldn’t be able to use this for everyday Windows activities.

Now that mining has been around for a few years, there are plenty of discussion forums and dedicated sites with tips and utilities to improve your hardware’s abilities. But if you’re just starting out, your first consideration will be what base hardware to choose for the best mining value. So this is what we will turn to next.

AMD versus NVIDIA – Which is Best for Mining?

Choosing the right hardware for mining is more difficult than for gaming, and doesn’t follow the same criteria either. What is good for gaming – and even some other activities – might not be the best choice for mining. For a start, there’s a difference between hardware intended to get the best performance for a few hours a day of activity, and something you’re going to run continually, 24 hours a day and seven days a week.

If you’re using the hardware to make money, the initial cost and power consumption also need to be taken into consideration, which is why there has been such a run on mid-range hardware during this latest mining craze. This usually offers the best balance between purchase price, running costs and capability.

But even more confusing is that whilst a given GPU might be better at certain games than others, if it’s good at one game it will probably be pretty good at others, particularly those using the same underlying engine. With mining, this is partially true, but there are numerous core hashing technologies, such as Claymore, CGminer, CCminer, sgminer, or EWBF, and there are variants on these as well.

Each of these core technologies supports multiple algorithms, which in turn can be used with multiple coins. You will get subtly or even hugely different performance with different algorithms on a given piece of hardware, making absolute statements about one being faster than another hard to substantiate.

The underlying technologies are also aimed at different GPUs, because NVIDIA predominately uses CUDA for acceleration, and AMD uses OpenCL. CCminer is aimed at CUDA, but there’s a CUDA implementation of EWBF. Claymore supports AMD and NVIDIA GPUs, but CGminer is primarily aimed at ASICs and FPGAs. It used to support GPUs, but that was dropped in 2013. So the technologies and algorithms are competing as well as the hardware, making benchmarking extremely tough.

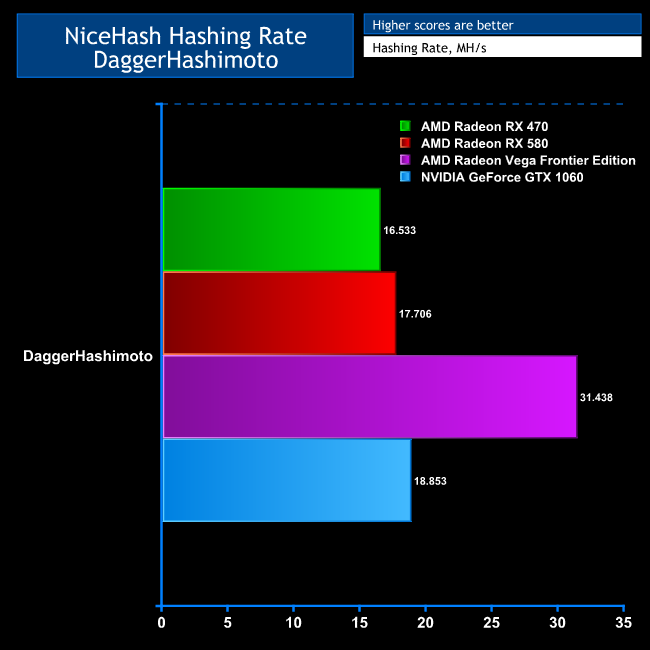

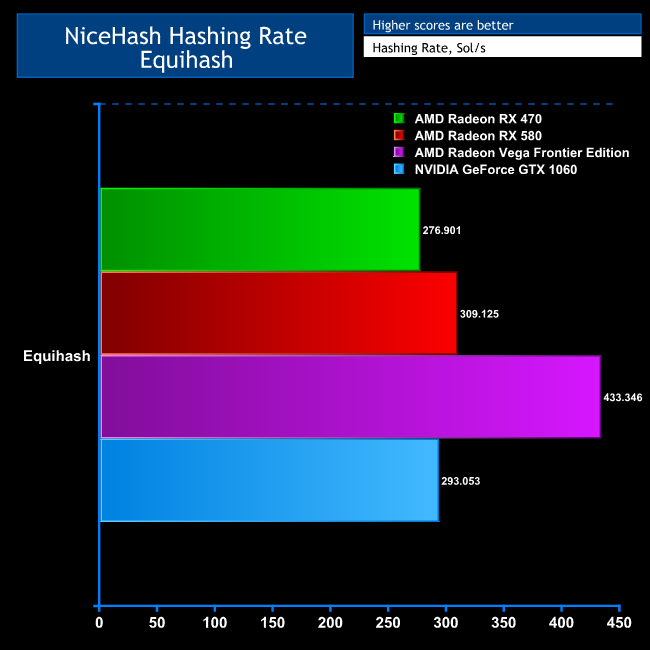

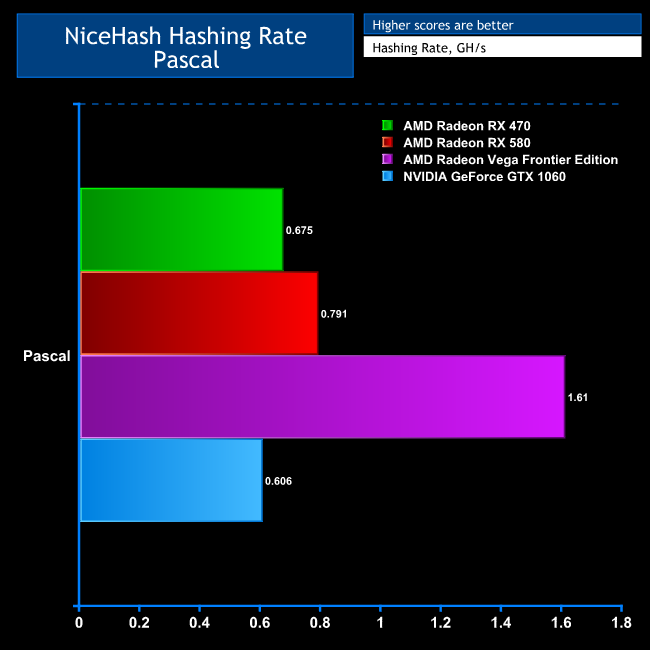

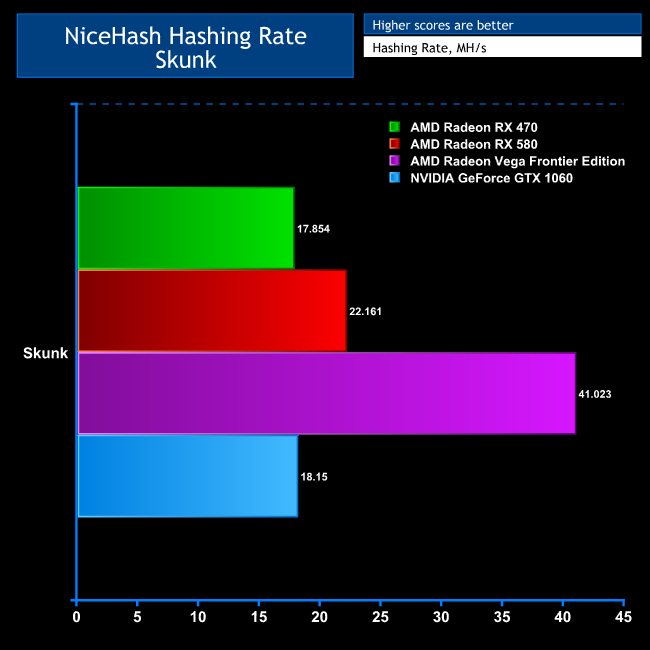

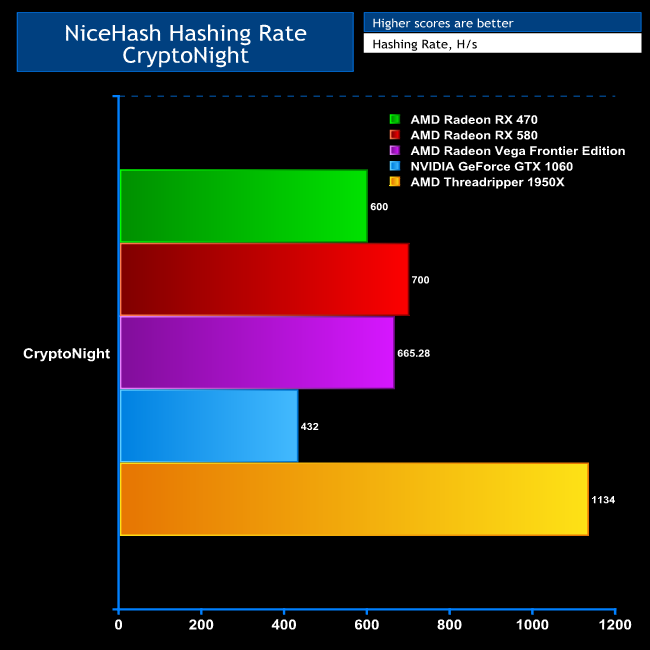

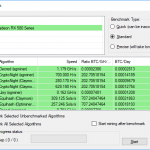

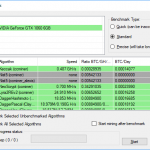

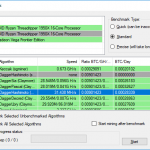

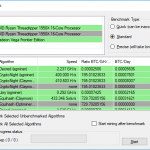

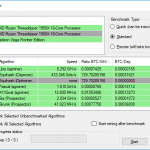

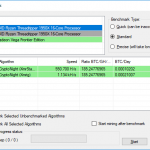

In order to give you a taste of what different hardware is capable of, we chose the algorithms that were considered most profitable during our NiceHash mining. We used the latter’s built-in benchmarking tool to tell us how our hardware selection was performing. We show the raw results below, but have included graphs for the six top algorithms as a sample of performance.

The GPUs on test include the Sapphire AMD Radeon RX 470 Mining Edition 8GB, Sapphire AMD Radeon RX 580 Pulse 8GB, and NVIDIA GeForce GTX 1060 Founders Edition 6GB, which reflect a selection of mid-range prices from £300 to £400. The NVIDIA GeForce GTX 1070 is also a popular mining card, but at over £500 would be an unfair match in this company.

Specifications

Sapphire AMD Radeon RX 470 Mining Edition 8GB

2,048 Stream Processors running at up to 1,236MHz

8GB of GDDR5 memory running at 1,850MHz

175W TDP

DVI connection only (also available with no graphics output)

£299.99, if you can find anyone selling it

Sapphire AMD Radeon RX 580 Pulse 8GB

2,304 Stream Processors running at up to 1,366MHz

8GB of GDDR5 memory running at 2,000MHz

235W TDP

2 x DisplayPort, 2 x HDMI, DL DVI-D

£389.99

NVIDIA GeForce GTX 1060 Founders Edition 6GB

1,280 CUDA cores running at up to 1,708MHz

6GB of GDDR5 memory running at 1,900MHz

120W TDP

2 x DisplayPort, 2 x HDMI, DL DVI-D

£349.99

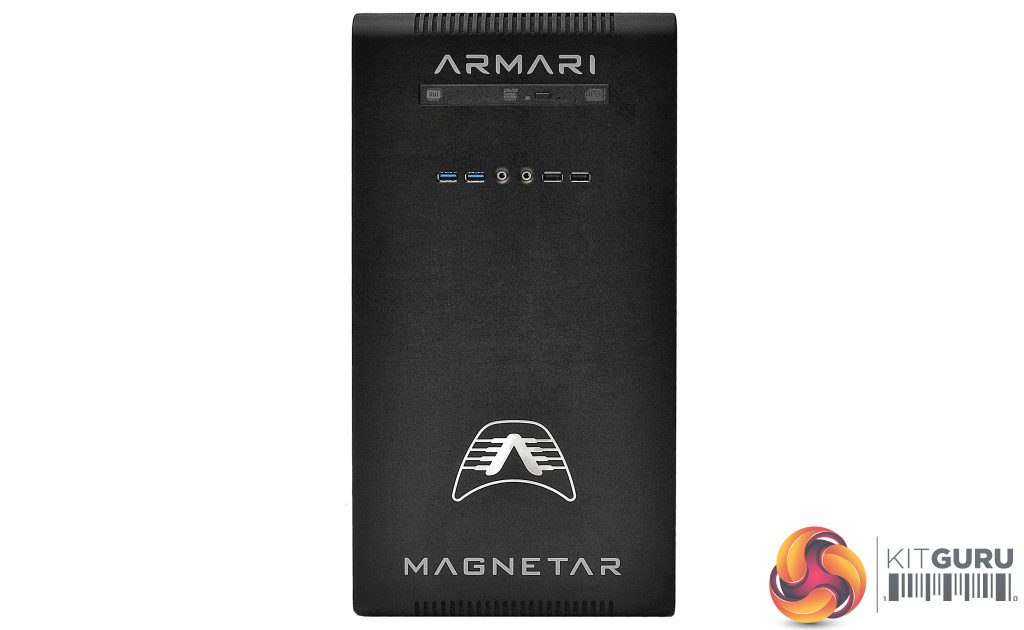

We have also included results from the Armari Magnetar S16T-RW850G2 we were using for our long-term mining experiments. This system includes AMD Radeon Vega Frontier Edition graphics and AMD Ryzen Threadripper 1950X CPU, both of which are considered pretty handy for mining, although the price of these components puts them in a different league to the three main graphics cards on test, so we only include the results for reference, as this system will be the basis for our section on whether mining is profitable compared to the everyday electricity costs.

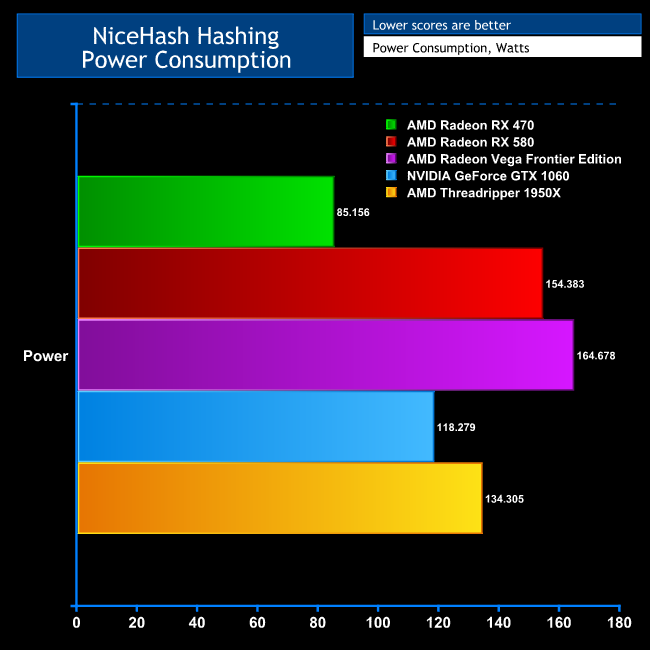

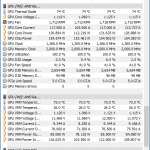

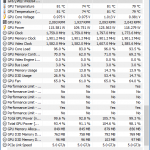

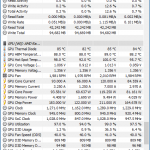

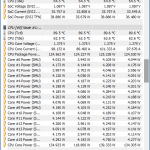

Since power consumption is as important as performance, after benchmarking each piece of hardware we left it mining on NiceHash for a short period and then used HDInfo64 to measure how much power it was consuming on average when mining at full pelt.

Here are our results.

DaggerHashimoto

The RX 580 is only seven per cent faster with DaggerHashimoto than the RX 470, and the GTX 1060 only six per cent faster than that. So the RX 470 is the best value in unit price versus performance terms, the GTX 1060 is second best, and the RX 580 third. However, the GTX 1060 is top in raw performance out of our three contenders.

DaggerDecred

With DaggerDecred, the RX 580 is 62 per cent faster than the RX 470, and the GTX 1060 is 17 per cent faster than the RX 470. So the RX 580 provides the best performance for the money, and isn't that far behind the Vega Frontier Edition in overall performance. The RX 470 and GTX 1060 are equal second, since the latter is 17 per cent more expensive and 17 per cent faster, so you get what you pay for.

Equihash

The RX 580 is 16 per cent faster than the RX 470, and the GTX 1060 is only six per cent faster. So the RX 470 is the best overall value again.

Pascal

The GTX 1060 is particularly poor with Pascal, coming in slowest of all. The RX 580 is only 17 per cent faster than the RX 470, so yet again the RX 470 is the best value.

Skunk

The RX 580 is 24 per cent faster than the RX 470, but it's 30 per cent more expensive. The GTX 1060 is only two per cent faster. Yet again, the RX 470 is the best value, with the RX 580 a close second, and GTX 1060 third.

CryptoNight

CryptoNight is an algorithm for mining CryptoNote coins like Dash and Monero. It’s unlike the other algorithms because it is aimed at CPUs rather than GPUs, although the latter can also run it. It’s very sensitive to memory speed, so the quantity of Level 3 cache available is key to how many threads you can run successfully at once, and thereby your hashing rate.

The AMD Threadripper 1950X and 1920X have 32MB of Level 3 cache, which allows up to 16 threads. However, Intel CPUs have significantly less Level 3, with even the Core i7 7980XE having 25MB, and the 7900X just 13MB, allowing them to run 12 and six threads respectively. Unfortunately, we didn’t have either of the latter available for comparison, but here is the AMD Ryzen Threadripper 1950X compared to our graphics card selection.

As you can see, the 1950X significantly outperforms the GPUs, and at the time of writing this performance equated to a couple of dollars in income a day, as much as a top-end graphics card with its best algorithms.

Power

If you needed any more evidence that the RX 470 is the best value mining card, its meagre power consumption should seal the deal. Consuming an average of 85W when at full pelt, it will cost 45 per cent less to run 24 hours a day mining than the RX 580. The GTX 1060, in comparison, will cost 39 per cent more than the RX 470, but 24 per cent less than the RX 580.

So, of our three mid-range cards, the GTX 1060 is likely to be second most profitable, and the RX 580 third, but the RX 470 is way out in front.

We have included the Vega Frontier Edition and Threadripper in this graph, because from a power consumption perspective they shape up well for mining, despite the initial cost. The Vega Frontier Edition consumes almost twice as much power as the RX 470, but it's also twice as fast with lots of algorithms. The Threadripper is also relatively cheap to run, considering its profitability.

Conclusion

Not surprisingly, the AMD Radeon Vega Frontier Edition rules the roost in performance terms, but this is a £1,200 graphics card aimed at professionals, and you’d get much more mining for your money with any of the consumer-grade options, since you could buy at least three for the same price, or even four RX 470s.

The Radeon RX 580 is still a great mining card, with great performance across a range of algorithms, but its power consumption is likely to make it less profitable in the long run than the RX 470. The GTX 1060 is somewhere in between, but you would still be better off with the RX 470.

It’s no surprise the Sapphire AMD Radeon RX 470 Mining Edition 8GB is currently so hard to buy. A rig with four of these could be making you a fiver a day, and costing less than £1.50 in power. So they would more than pay for themselves in a year, and possibly make a decent profit if cryptocurrency values go up again.

The AMD Threadripper’s abilities are also encouraging. This CPU is about twice the price of our GPU selection, but with AMD’s EPYC CPUs offering 64MB of Level 3, CPU mining is definitely going to be increasingly important. Considering that the CPU only draws 134W for around $2 of daily income, it’s definitely profitable to mine on your Threadripper when you’re not using it for something else. The CPU is only running at 50 per cent utilisation to achieve this, too, so isn’t likely to burn out either.

Of course, these profits assume no further charges, but this is far from the reality. So next next let’s turn to what happens to your mining income, how you can spend it on real goods, and whether it’s profitable in the long run.

Raw Results

Where Should You Keep Your Crytpocurrency?

So far, we have worked out what kind of hardware is currently best for mining, and mined some cryptocurrency. But what should we do with our cryptomillions next? All cryptocurrency value is kept as a transaction record on the blockchain. But you need some method of interfacing with the blockchain, and this comes in the form of a virtual wallet, which is usually a service provided by a third party.

As we mentioned earlier, NiceHash has its own internal wallet, so you can deposit the cryptocurrency you earn within the same system, although you can use other wallets as well. Just depositing from the miner to the internal wallet elicits NiceHash taking a cut, and this will only be the first piece of your cryptocurrency pie you will need to share with intermediaries as you try to extract the value you have accrued for buying something useful.

Mining payouts to NiceHash’s internal wallet will incur a two per cent charge, and if you transfer less than 0.1 Bitcoins to an external wallet it will be five per cent, although this drops to three per cent above 0.1 Bitcoins. Unless you spend your Bitcoins directly (about which more shortly), you will need to use an exchange to turn your cryptocurrency into “fiat” currency (ie one backed by a government).

At the beginning of this feature, we explained how money was derived from exchange of actual material goods, which is something that seems to get lost in many financial discussions despite its obviousness. This is particularly the Achilles Heel of Bitcoin. At the beginning of January 2018, one of the most seamless methods for using Bitcoins to buy actual things was shut down. Visa stopped supporting Bitcoin, which in turn prevented BitPay, Cryptopay and Bitwala from providing Visa-related services.

In particular, this included the ability to load a pre-paid debit card with local fiat currency purchased using cryptocurrency. This could be a virtual Visa debit or even a physical card you could use in an ATM or shop. Fees were involved along the way from mining wallet to prepaid Visa debit card. But at least this meant there was a relatively streamlined route towards using your mining earnings to buy actual stuff, such as chickens or cows.

Sadly, that route has now been closed, and everywhere you turn the options are being made harder and more expensive. The established finance industry has taken an increasingly negative stance towards cryptocurrency, particularly after the furore around Bitcoin’s value hitting $20,000. We will be looking at the options that still existed at the time of writing in the next section, using our own mining profits as a test case. But there’s another problem to consider first.

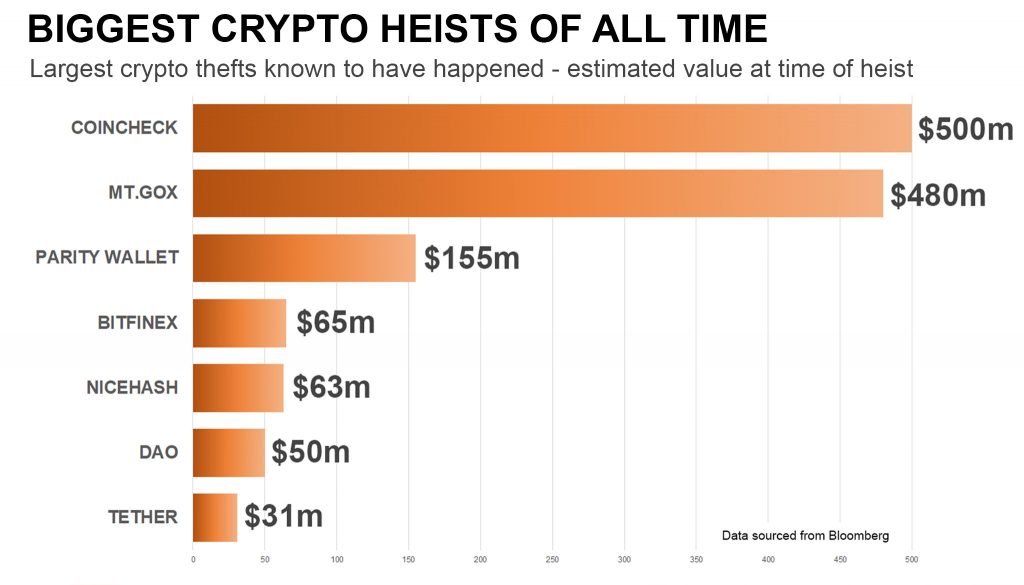

Aside from the considerable difficulty of turning cryptocurrency into cash you can actually spend, there is also the issue of security. We will return to this theme at the end of this feature when we focus on the many structural problems currently facing cryptocurrency and blockchain technology, but for now consider how the huge losses from the numerous exchange hacks have become headline news. We’ve already mentioned the NiceHash loss at the end of 2017, and just a month later, hackers stole $400 million of the NEM cryptocurrency from Coincheck in Japan.

This is nothing new. One of the first and earliest successes in the exchange business, Mt. Gox, lost a whopping 850,000 Bitcoins in February 2014. At the time, this was worth $450 million, but when Bitcoins hit $20,000 a few months back, it would have been valued at $17 billion – more money than Facebook’s annual revenue. Lack of security appears to be a recurring theme with Bitcoin and cryptocurrency in general.

Any exchange-based wallet is potentially susceptible to this kind of attack, particularly considering the immense on-paper values involved, and here cryptocurrency’s strength is also its weakness. Without any government backing or regulation, there’s nothing you can do if your exchange wallet is hacked. You can’t even take advantage of the £85,000 of protection available to bank accounts in the UK.

The alternative is to host your own “cold” wallet. But this is not for the faint hearted. It involves keeping a copy of the ENTIRE blockchain on your own local machine or storage device. At the end of 2017 the Bitcoin blockchain exceeded 150GB in size. This is another problem factor we will be discussing at the end of this feature. But the sheer size of the Bitcoin blockchain means only the very technically savvy should even consider it. You’re also then entirely responsible for your own security. You may want to invest in a serious safe and keep your blockchain storage locked in there when you’re not updating it with more funds. This is heavily ironic, when cryptocurrency is supposed to be money separated from governments and the physical world in general.

Where can you spend cryptocurrency?

It’s mainstream news now that the easy routes to turning cryptocurrency into fiat currency and vice versa have mostly been blocked in the last few months. UK credit card issuers have recently blocked purchasing cryptocurrency, and most UK banks make it very hard to receive currency from exchanges. Even Steam has stopped accepting Bitcoin (about which more later). So how do you actually spend your Bitcoins, Ether, and Dogecoin?

After mining via a pool like NiceHash, Minergate or Mining Pool Hub, your earnings will be stored in an internal or external wallet in the denomination of a cryptocurrency. Litecoin is recommended by some miners as the fees are often the lowest, but in the case of NiceHash, all balances are kept as Bitcoin, even though most of the time your hardware probably hasn’t been mining this coin, if at all.

You can only spend your cryptocurrency directly where your specific coin is accepted natively, which increasingly seems to be just the Dark Web. For most everyday uses, you will need to convert your cryptocurrency to fiat currency, and this requires an exchange. There are quite a few of these around, but the most popular choices include Coinbase, CoinMama, Cex.io, Localbitcoins, Bitstamp, Bittrex, Kraken, Bitsquare, Coinhouse and Poloniex.

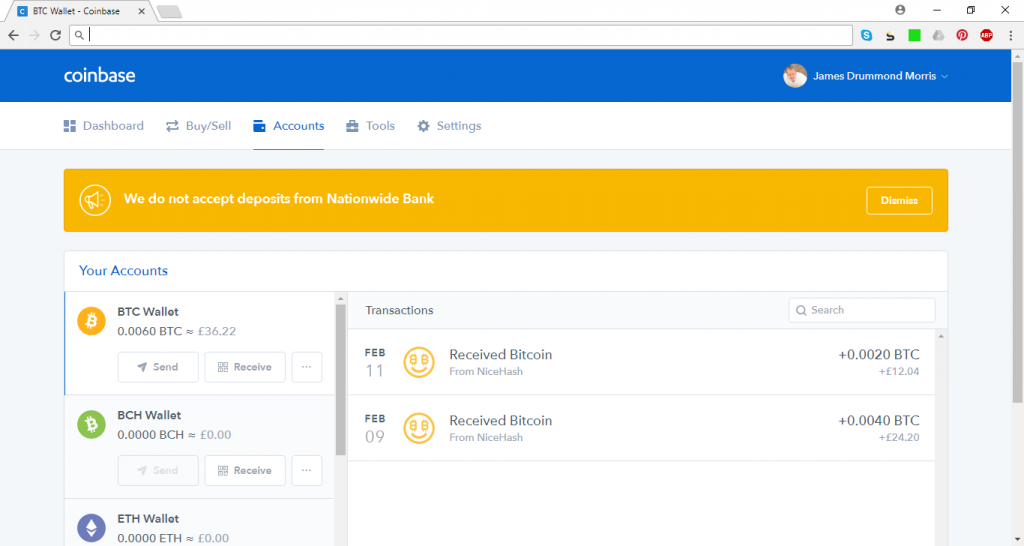

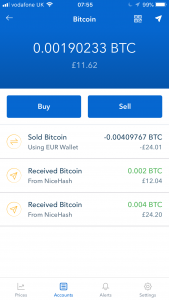

We chose to use the Coinbase option to get our NiceHash earnings onto a mainstream exchange, because that’s free for withdrawals from NiceHash above 0.002 Bitcoins (although it rises higher when the API is under heavy load). With other exchanges, you lose yet another 0.0005 Bitcoins, unless you have more than 0.1 Bitcoins, in which case it’s 0.5 per cent. All these charges need to be taken into account when you calculate whether you’re really making any money from mining. We’ll be including this factor in the next section in this feature.

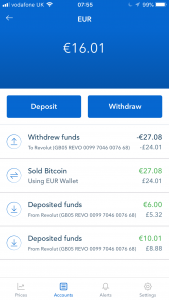

Sending Bitcoins from NiceHash to Coinbase is a simple case of entering the email address of your Coinbase account, and they are transferred immediately. Once your coins are on an exchange, you can swap between different cryptocurrency denominations, and also sell them for fiat currency. This may incur a charge of some sort, depending on the exchange. Coinbase charges 1.49 per cent, but also seems to have a minimum fee, as we were charged a flat Euro to convert to this currency.

The reason why we chose Euros was because Coinbase doesn’t support deposits or withdrawals in Pounds Sterling. You can still send money to some UK banks, but it will be sent in Euros and the bank will convert it for you, incurring still more charges. The method used is called SEPA (Single Euro Payments Area), and it operates via the International Bank Account Number (IBAN). Despite the name, SEPA includes non-Euro countries such as the UK, Sweden, Norway and Switzerland. It’s a well-established system, but fees can be high. For example, Santander charges £15 to send a SEPA payment, although not for receiving funds this way.

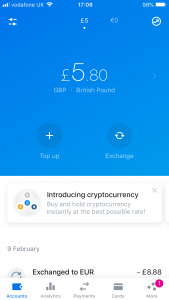

We spent some time looking for the optimal alternative to a regular UK bank with the least charges, and the solution we came up with for now is a virtual bank account called Revolut. This is aimed at mobile users and has the ability to hold funds in lots of different fiat currencies. It can instantly exchange between them with decent rates and no fees. It can provide you with a virtual debit card and can even issue you with a real physical debit card. There is experimental support for cryptocurrency, but this is only internal – you can’t pay into Revolut with cryptocurrency.

Howver, Revolut can send and receive via SEPA using an IBAN, which makes it possible to receive funds from a cryptocurrency exchange if those funds are already in a fiat currency. So once you’ve registered and validated your exchange account, which usually involves sending an image of some photo ID to the exchange, you can move to the next stage of validating your bank account for sending and receiving fiat funds.

To set up this relationship between Revolut and Coinbase, you have to put some funds in your Revolut account and convert these to Euros. Then you have to set up Coinbase as a recipient for bank transfer and send some Euros. You can find Coinbase’s IBAN details on the company’s support pages, and you will also need a unique reference from your Coinbase account, which you can find in the Linked Account section under Bank Account.

You then send some Euros from Revolut to Coinbase. There’s some controversy about how much this should be. On the Coinbase smartphone app it says a single Euro, but the website implies it needs to be more than ten Euros. Either way, it takes a few days for the payment to clear, but once it does, you should be able to send funds the other way from Coinbase to Revolut. So you can exchange your cryptocurrency for Euros on Coinbase, send those Euros to your Revolut account, and once they’re cleared, you can exchange them to whatever fiat currency you need, and use the Revolut virtual or real debit card to spend it.

This is a pretty tortuous process, but we found that once it was set up, the only bit that took time was the transfer from Coinbase to Revolut. Transferring from NiceHash to Coinbase, and from Bitcoins to Euros within Coinbase, were both immediate. We’ll look at all the charges involved in the next section, to see if all this rigmarole – plus the electricity costs of mining – are worth the effort.

Calculating the Potential Profits, If Any

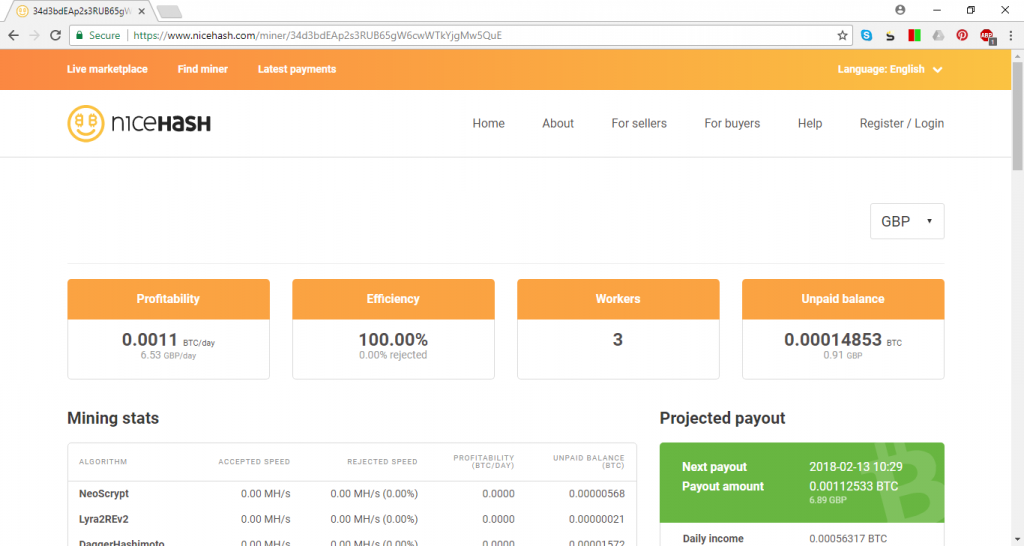

Throughout this feature, we have stressed the importance of power consumption when considering whether mining is going to make you any money. For this portion of the feature, we used the Armari Magnetar S16T-RW850G2 workstation that is mentioned in the testing section.

For our long-term mining, we ran 16 threads on the AMD Ryzen Threadripper 1950X, which results in 50 per cent utilisation, and used MSI Afterburner to reduce the AMD Radeon Vega Frontier Edition to 80 per cent of its maximum power. The Threadripper only has enough Level 3 cache for 16 threads, but in the case of the Vega Frontier Edition we were trying to avoid long-term damage to the card from running it at 85C for days on end. At 80 per cent power it runs at 65C.

When both CPU and GPU were fully utilised in mining (within the limits above), the overall system was consuming 343W on average according to our external power meter, for a total of 8.232kW per day. Our electrical supplier charges 15.72p per kWh plus five per cent VAT. So a day of electrical usage costs £1.36.

Over a typical three-day cycle between payouts, this system was earning 0.00041813 Bitcoins per day. The value of a single Bitcoin varies greatly over a day – sometimes by as much as 20 per cent – but as a reference, at the time of writing this particular paragraph it was £6,035.23 per Bitcoin. In other words, our system was earning £2.52 a day.

Deducting electricity costs, our profit was therefore £1.16 a day – enough for a packet of crisps and a can of soft drink from your local supermarket. But at least we’re making a profit.

However, electricity isn’t the only charge. NiceHash takes 2 per cent to transfer mining proceeds to its wallet, reducing our 0.00041813 to 0.0004097674 Bitcoins. That in turn reduces our earnings to £2.47 a day and our profit to £1.11.

Fortunately, the next stage – transferring to the Coinbase exchange – is free. However, because of the minimum transfer to Coinbase was 0.004 Bitcoins at the time due to the API traffic, we transferred ten days’ worth, which was 0.004097674 Bitcoins.

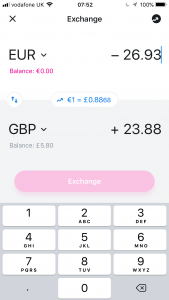

Transferring this quantity to Euros within Coinbase was performed at a rate of €6852.67per Bitcoin, and we also paid a Euro for the privilege, giving us €27.08 Euros in our Coinbase Euro wallet. Transferring this to Revolut then cost €0.15 and took three days to clear, giving us a final payout of €26.93.

Finally, we turned this into pounds within Revolut at a rate of £0.8868 to a Euro, ending up with £23.88 overall to go out and spend.

Considering this was ten days of mining, our £23.88 had cost us £13.60, for a £10.28 profit.

In other words, we are making some money out of mining, assuming negligible wear on our hardware. Over a year, this could be a profit of £375.22, which is starting to sound more worthwhile, and if Bitcoin values go up the profits could increase.

That’s enough for a weekend away, and certainly could buy quite a few whole chickens, though only about a sixth of a cow.

Sapphire Radeon RX 470 Mining Edition, RX 580 Pulse and NVIDIA GeForce GTX 1060 Profitability

We should also say a few words about how much money you could make with our three example graphics card contenders. We will be using the reading from NiceHash found in the testing section for how much money each was making. The question is, how long will it be before the hardware pays for itself?

The Sapphire Radeon RX 470 Mining Edition was making $1.54 a day, which is £1.11 in British money. It was consuming 85.156W, which at 15.72p per kWh plus 5 per cent VAT is 34p a day. That means 77p a day in profit. With the card costing £299.99, it would be 388 days before you turned a profit.

The Sapphire Radeon RX 580 Pulse was making $1.95 a day, which is £1.41 in British money. It was consuming 154.383W, which at 15.72p per kWh plus 5 per cent VAT is 61p a day. That means 80p a day in profit. With the card costing £389.99, it would be 487 days before you turned a profit.

The NVIDIA GeForce GTX 1060 was making $1.68 a day, which is £1.21 in British money. It was consuming 118.279W, which at 15.72p per kWh plus 5 per cent VAT is 45p a day. That means 76p a day in profit. With the card costing £349.99, it would be 458 days before you turned a profit.

These calculations show again why the RX 470 is such a popular mining card. The daily profitability is similar across all three cards, with the RX 580 top, RX 470 second, and GTX 1060 third, and just a few pence between them. But the low cost of the RX 470 means you that you turn a profit much more quickly, after which power is the only expense, so you'll make more money in the long run with this card than the other two.

Whilst the days of mining to become a cryptocurrency millionaire might be over, unless you have the capital for a datacentre full of hardware, you can certainly make some money out of it. However, there are still some issues to be aware of, which we will cover in our concluding section.

The Use and Misuse of Cryptocurrency

Over the course of this feature, we’ve tried to show both sides of the story. We’ve explained the details of cryptocurrency, warts and all, but also illustrated that you can make some money out of mining, even with the increasing difficulty of converting your earnings into fiat currency or spending them directly. Nevertheless, the problems with cryptocurrency are pretty major, and we couldn't get to the end of this feature without mentioning some of them.

First of all is the question of how you can spend cryptocurrency on real goods, like cows and chickens. It used to be possible to spend Bitcoins on Steam, but this ended in December 2017. It had been possible to purchase games and assets on Steam via Bitpay. At the time that this service started in April 2016, Bitpay’s transactions cost around $0.20. But this fee had risen to at least $20 by the end of 2017, bordering on the price of the software being purchased.

The value of Bitcoin also changes so rapidly that the amount of currency needed to cover a purchase can be significantly different when the transaction is initiated compared to when it is completed. Resolving this with another transaction could then incur yet another exorbitant fee, and this could be susceptible to the same change in exchange rate. And so on.

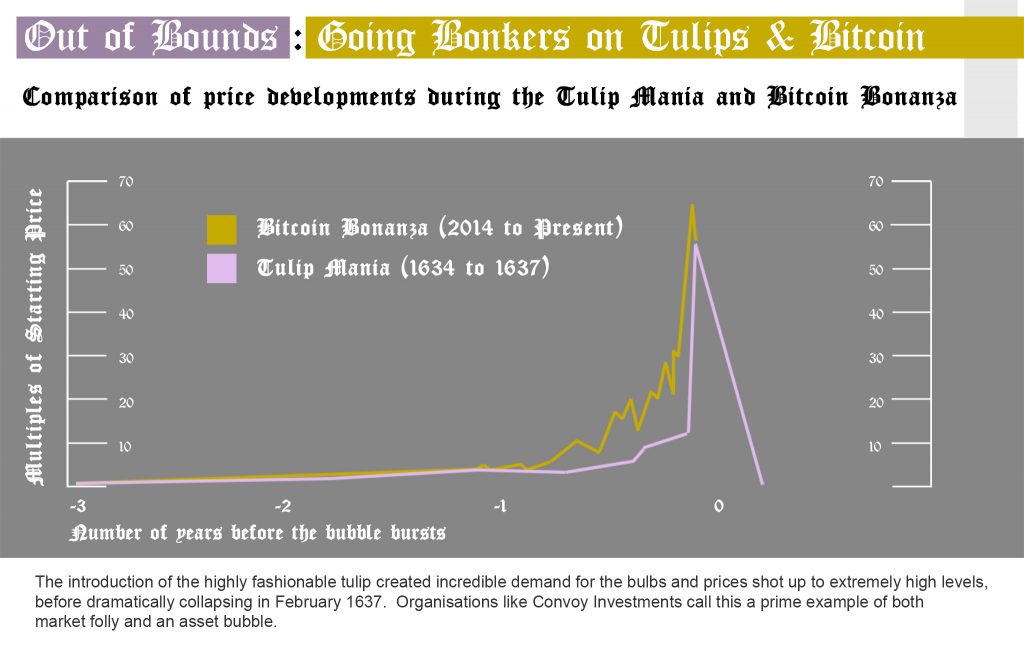

This volatility of cryptocurrency value compared to fiat currencies is a real problem, and periods of high value have been accused of being a like the Dotcom Bubble, the South Seas Bubble, or the Tulip Mania of the 17th century, all of which crashed and burned, taking thousands of investors with them. Countries like Zimbabwe that have experienced hyper-inflation have had a similar conundrum, where nobody knows how much anything costs. This instability has dire consequences for the functioning of the economy. You can’t plan a supply chain reliably with this much fluctuation.

The most recent $20,000 spike in Bitcoin has been considered as the effects of the Tether token. This strange token is tied directly to dollars rather like the way dollars were once tied to gold, and the company claimed to have a store of actual dollars to back the value of its Tether currency. This pushed the value of Bitcoin up astronomically, but when the company began being investigated for maybe not actually having the dollars it claimed to have, the price of Bitcoin crashed back down again.

Another problem for many cryptocurrencies is scalability, and this is part of the reason for the increasing transaction costs of Bitcoin. The latter can process maximum of seven transactions per second globally, and Ethereum only manages 15. Putting this in perspective, Visa processes an average of 1,667 transactions per second and could cope with 56,000 per second. Paypal processes an average of around 200 transactions per second, with a peak close to 500 per second at times of heaviest usage.

The leading cryptocurrencies, at least in their current forms, simply couldn’t cope with the volume of business from mainstream commerce. However, alternatives to Bitcoin and Ethereum are addressing this. Ripple is much more of a contender in this respect with its 15,000 transactions per second, and as we noted in our section on different coins, there are others that might also be viable.

Another problem is how much energy mining and blockchain maintenance now consumes. At the time of writing, Bitcoin was using 47TWh and Ethereum 13TWh. To put this in perspective, Bitcoin consumes as much energy as Singapore, and Ethereum as much as Myanmar. The trend is up, which is clearly untenable in the long term, unless some incredibly cheap form of renewable energy comes online.

Again, though, this energy problem primarily applies to cryptocurrencies that use proof-of-work rather than proof-of-stake consensus. By their very nature, proof-of-work algorithms need to increase in difficulty over time, as this is part of how the scarcity system operates, and this necessitates ever more powerful hardware. But consensus-based cryptocurrencies don’t have this issue. For example, Ripple XRP has negligible transaction costs in energy terms, like fiat currency. So power consumption is not a deal-breaker for cryptocurrency in general.

A third issue, which has been mentioned in passing numerous times during this feature, is the lack of security in cryptocurrency. Exchanges are hacked on a regular basis, and the scams from ICOs mean there are lots of ways you can lose your hard-earned coins. There is also a concern that quantum computers could break the cryptographic maths of blockchain, rendering the whole system insecure, although quantum computers are still mostly at the theoretical stage. As a result, there are also new blockchains in development that won’t be susceptible, such as the Quantum Resistant Ledger.

Despite the huge interest in cryptocurrencies and the considerable number of coins and tokens now available, there’s still no guarantee that they’re not just a fad. Governments are cracking down, and the options for converting cryptocurrency to fiat currency you can actually buy things with appear to be reducing all the time.

After all, as we explained towards the beginning of this epic journey, cryptocurrency is as much ideology as it is technology. It was created to subvert the financial control of governments and banks, and these incumbent institutions aren’t going down without a fight. The scams and hacks aren’t helping the image for mainstream adoption, either.

If you’re thinking about trying out mining, as we have shown, it is currently possible to make a little bit of money that you can still spend. However, it’s probably not advisable to see cryptocurrency as your new route towards mega riches. There are a few cases of fortunes being made, but these are usually people who got in early, and avoided getting hacked whilst holding onto their early mining gains.

Despite this, learning about cryptocurrency and mining can be great fun. We’ve had a blast putting this feature together. If you look at it more as a pastime that might make you a bit of cash on the side, you’re going to have a good time. Like tuning a rig for optimum gaming performance, there’s still a lot of enjoyment to be had from getting the most out of your hardware for cryptocurrency mining.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards